Finance 3.0 represents a shift towards more inclusive, transparent, and efficient financial systems. This new paradigm is fuelled by the ascendancy of digital mechanisms that make the issuance, trade, and lifecycle management of financial assets more accessible, more accountable, and more secure, says Bloem.

“The largest capital markets players in the world are on a trajectory towards the digitisation of all classes of financial assets,” she says. “Mesh.trade’s Issuance Hub allows a company to issue a fully compliant digital security, and trade it directly with their investor base in under 30 minutes. That is where innovation converges with opportunity to redefine the very essence of the open capital markets of the future.”

Expanding on what this means, Bloem says: “As traditional markets witness a notable exodus of companies from public exchanges, a compelling narrative is unfolding within the realm of private markets. Globally, the trajectory is clear: whilst public markets recede, private markets surge forward, with African private capital markets notably outpacing global trends by a remarkable 46%.”

She says that this seismic shift underscores a palpable transition from public listings towards the allure of private capital investment.

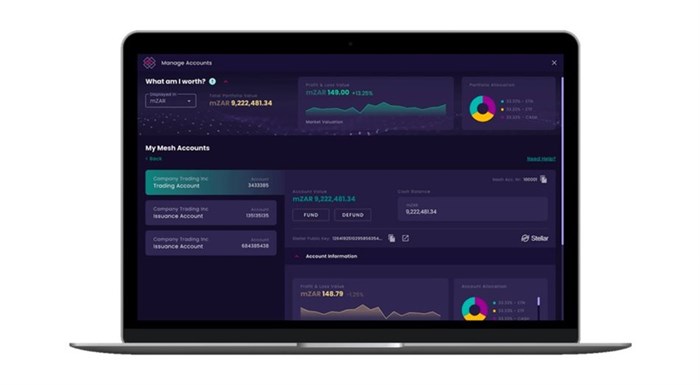

Before unpacking what smart assets are, it is useful to understand what Mesh.trade does. “Mesh.trade is a digital capital markets ecosystem for raising capital and trading capital markets assets. Mesh integrates deep experience in financial engineering, a comprehensive and streamlined approach to regulatory compliance, and cutting-edge technology infrastructure, to create open capital markets that are easy to access, simple to use and transparent,” says Bloem.

Mesh.trade is a multi-sided platform, providing an alternative avenue for high-growth enterprises seeking to raise capital without the protracted, arduous, and prohibitively expensive journey of a primary listing. Simultaneously, Mesh.trade provides an ecosystem for investors to get direct access to assets they otherwise would never have been exposed to.

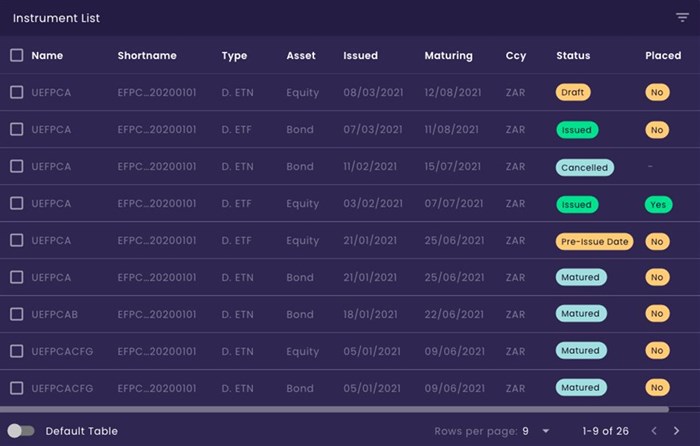

Designed to accommodate multi-asset portfolios, Bloem says that Mesh.trade lays the groundwork for instrument innovation, giving rise to a broad spectrum of asset classes, which she says is the hallmark of the Mesh.trade ecosystem.

Smart assets are transformative, providing new and compelling investment opportunities in alternative finance and private capital assets. According to Bloem, key features of smart assets include:

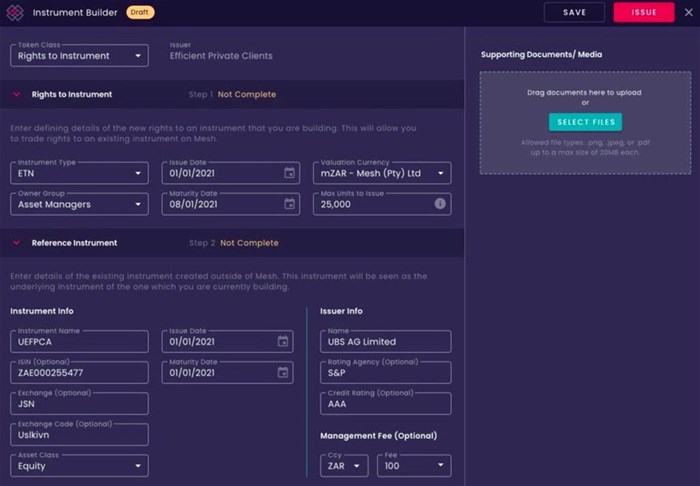

Flexible instrument creation: From equities to debt, commodities, and derivatives, Mesh.trade empowers the creation of bespoke instruments tailored to unique investment objectives.

Digital ownership and custody: Assets are fully digitised, enabling seamless and secure issuance, trade, custody, and lifecycle management.

Digital settlement and distribution: Guaranteed settlement for all trade and distribution payments, ensuring swift and reliable transactions.

Legal Robustness: Smart legal contracts ensure full compliance with regulatory frameworks, instilling confidence and transparency into every transaction.

Backed up by the recent R182m capital injection from Convergence Partners, Bloem says that she believes that Mesh.trade is at the leading edge of an era of Finance 3.0, offering issuers and investors “the most compelling and diverse array of new, and smart capital raising and investing opportunities available today”.

She says that Mesh.trade will announce a groundbreaking, first on the continent smart asset issuance within the coming weeks.