Will SA's short-term insurance industry weather the Covid-19 storm?

Insight Survey’s latest SA Short-Term Insurance Industry Landscape Report 2020, carefully examines the global and local Short-Term Insurance landscape, based on the latest research and information. It describes the latest global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African Short-Term Insurance industry environment and its future.

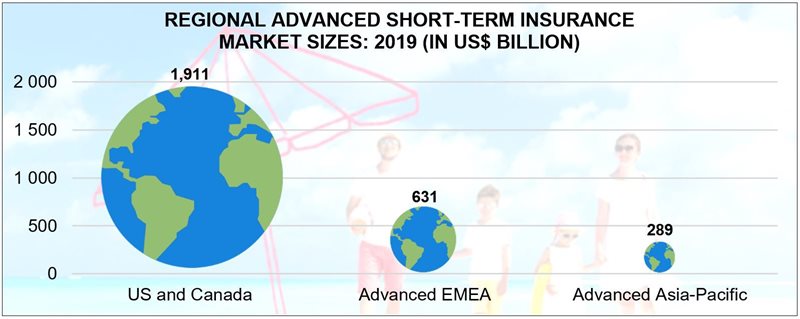

Globally, the overall insurance industry had been on a solid growth trajectory, prior to the Covid-19 pandemic. In particular, the Short-Term Insurance industry increased by 3.5% in 2019, to reach approximately US$3.4tn. Regionally, North America (i.e. the US and Canada) continued to represent the largest advanced market in terms of premium value in 2019, as per the graph below. The global economic recession, induced by the Covid-19 pandemic, has significantly impacted market growth in 2020, although the market is anticipated to rebound slightly in 2021.

Before the Covid-19 pandemic, the South African Short-Term Insurance market was also on a strong growth trajectory, increasing by a solid 4.3% in insurance premium volumes, between 2018 and 2019. However, similar to the global market situation, the local market has been negatively impacted by the Covid-19 pandemic and subsequent lockdown measures, with a growing number of consumers unable to pay their insurance premiums. There has also been a sharp decline in consumer confidence in Short-Term insurers, as many insurers have been reluctant to pay business interruption claims, negatively impacting the reputation of the Short-Term Insurance industry.

A number of market trends have been developing, based on the specific impact of the Covid-19 pandemic. In particular, niche risk solutions have gained popularity in South Africa, as many consumers and businesses are taking advantage of the certainty of niche insurance solutions. Despite broad insurance coverage, such as motor, household, and business assets, remaining under pressure, specialised niche insurance products are seeing substantial growth. These include mechanical warranty, risk insurance and goods in transit cover, travel insurance, and cybercrime insurance.

In terms of other industry innovations and technological developments that have positively impacted the market, a new insurance advice app, BluPixl was recently launched. This app allows consumers the ability to choose and manage their insurance cover, based on their personal and individualised needs. The BluPixl app is powered by Indwe, one of the country’s largest independent insurance brokers, and integrates both insurance expertise and smart technology, to assist consumers in finding cover that suits their lifestyle and budget.

Furthermore, a new insurance solution, Solvency, is disrupting the industry with its Insurance Savings Account (ISA), that is funded through car and household insurance premiums. The solution offers vital risk cover and savings investment opportunities, all within a single monthly premium, with clients’ insurance premiums being linked to a savings account. This allows consumers to have complete control over what percentage of their premiums go to risk, and what percentage goes into direct savings, which can earn additional interest.

The SA Short-Term Insurance Industry Landscape Report 2020 (168 pages) provides a dynamic synthesis of industry research, examining the local and global Short-Term Insurance Industry from a uniquely holistic perspective, with detailed insights into the current market dynamics and stakeholder positioning – from market size, industry trends, industry innovation and technology, industry drivers and challenges, to competitor and product analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (overview, market environment, Covid-19 impact and key regional markets) of the Global Short-Term Insurance industry?

- What are the latest South African Short-Term Insurance trends (including tech and Insurtech), innovation, drivers and challenges?

- How did Short-Term Insurance companies perform in 2019/20, what is the strategic focus and expansion plans?

- How is each of the Short-Term Insurance competitors positioned and what products do they offer?

- What is the latest marketing and advertising news for each of the Short-Term Insurance players?

Please note that the 168-page report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased. For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: South African Short-Term Insurance Landscape Brochure 2020

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 10 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.

- How are mobile platforms and the metaverse driving SA’s long-term insurance industry growth? 6 Mar 2024

- Multi-strain products supporting South Africa’s probiotics market culture 22 Nov 2023

- Bridging the gap: Embedded insurance trending in SA's short-term insurance industry 15 Nov 2023

- Sustainable packaging pumps South Africa's bottled water industry 4 Oct 2023

- Specialised diet pet foods trending in the South African market 27 Sep 2023

Insight SurveyInsight Survey is a South African B2B market research company with almost 15 years of experience. We specialise in telephone interviews, online surveys, industry analysis and competitive intelligence to help improve or grow your business. |