Is SA's love for fast food still growing?

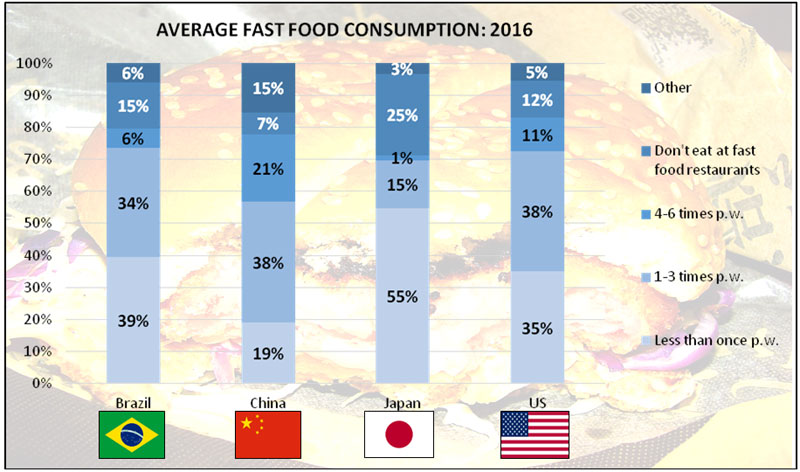

The global fast food market was estimated to be worth US$570 billion in 2015 and is expected to see a continued compound annual growth rate (CAGR) of 4.4%. The Asian markets are predicted to experience the most growth over the next few years. Interestingly China has the highest percentage of consumers that eat fast food at least once a week with 59%. In South Africa, only 18% of South African adults eat at a franchised fast food outlet at least once a week, similar to Japan (16%).

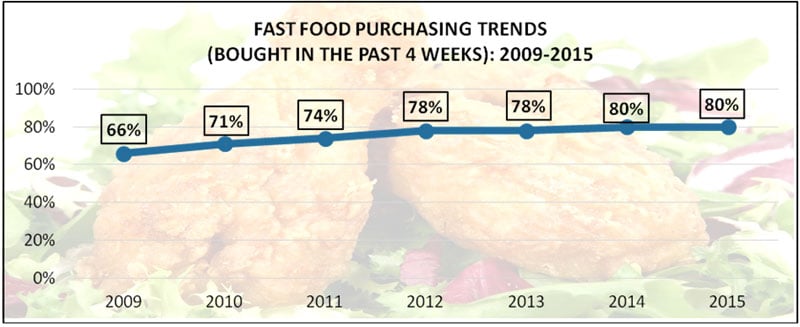

The more recent statistics in South Africa point to trends that are contrary to the global growth being experienced, especially the developing economies of Asia-Pacific. The percentage of South African fast food purchasers (16+ years old) who had bought fast food in the previous four weeks had experienced strong growth between 2009 and 2012, from 66% to 78%. However, since 2012, the proportion of South Africans purchasing fast food has plateaued around 80%.

The South African market has become increasingly competitive and saturated; hence the need for reactive product differentiation strategies as a fundamental means of carving out market share with many fast food brands marketing value through combo meals and larger-sized portions.

At the lower end, consumers have become very price sensitive due to the challenging economic climate. A recent survey amongst lower LSM consumers indicated that 80% chose to eat ‘street food’ over fast food. Their rationale was based primarily on cost, but also included aspects of taste and conviviality. Chesa Nyama strategically capitalised on this gap in the market, formalising the quintessential ‘street food’ product from a franchise perspective, in so doing both maintaining its socio-cultural heritage, whilst simultaneously marketing it as a "Local is Lekker" experience to higher LSMs.

Among the upper-income segments, food trucks and food markets have grown in popularity as an alternative to fast food. They focus on using organic, locally sourced, fresh and healthy ingredients providing a twist on South Africa foods as well as foods with foreign influences such as Mexican, Moroccan and Italian.

In order to stay competitive, fast food companies are expanding into Africa and have managed to limit price increases by: putting pressure on suppliers to keep costs down, experimenting with alternative ingredients without sacrificing quality and even looking at cheaper packaging alternatives. At the same time, companies are having to address consumer needs with healthier menus and new tastes.

It is evident from our nuanced analysis that the fast food environment is currently under pressure and the doctrine of ‘change being the only constant’ is an accurate lens through which to view the fluid market dynamics of the South African fast food industry.

The Fast Food Industry Landscape Report 2016 (124 pages) provides a dynamic synthesis of industry research, examining the local and global fast food industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to retailing, competitor positioning, latest marketing and advertising news for each competitor, pricing and promotions analysis, consumption and purchasing trends.

Some key questions the report will help you to answer:

- What are the key factors that are driving the growth of the local and global markets?

- What are the local and global industry challenges currently restraining market growth?

- What are the latest South African fast food and street food trends (food trucks, food markets)?

- How did fast food companies perform in 2015/16; what is the strategic focus and expansion plans?

- How are each of the fast food competitors positioned in the market?

- What is the latest marketing and advertising news for each of the fast food competitors?

- What is the pricing and recent promotions by category: Burgers, Chicken, Pizza, Pies?

- What are the local consumption trends between 2009-2015 in the fast food industry?

- How has the geo-demographic profile of fast food purchasers changed between 2009 and 2015?

Please note that the 124-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: SA Fast Food Landscape Report 2016.

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za. Alternatively, contact +27 (0)21 045-0202.

- How are mobile platforms and the metaverse driving SA’s long-term insurance industry growth? 6 Mar 2024

- Multi-strain products supporting South Africa’s probiotics market culture 22 Nov 2023

- Bridging the gap: Embedded insurance trending in SA's short-term insurance industry 15 Nov 2023

- Sustainable packaging pumps South Africa's bottled water industry 4 Oct 2023

- Specialised diet pet foods trending in the South African market 27 Sep 2023

Insight SurveyInsight Survey is a South African B2B market research company with almost 15 years of experience. We specialise in telephone interviews, online surveys, industry analysis and competitive intelligence to help improve or grow your business. |